Morning! Contradicting data coming out of PLG this week. A top VC arguing that 2023 is not the year for PLG after all, while a founder is leveraging PLG to take a swing at behemoths.

Filled out the PLS survey yet? Take 3 min to answer how companies are tackling product-led sales head-on. Respondents get priority access to results.

Here’s what you missed👇

🌎 How the economy hurts your bottom-up motion

🆚 PLG vs Enterprise

❌ Stop relying on humans for lead scoring

💣 Using PLG to take Microsoft down

Scroll to the end for 🎁 Cheat sheets & templates, 📊 New Data, 🎧 Podcasts, 📺 Videos and 🔥 Hot conversations.

🌎 How the economy hurts your bottom-up motion

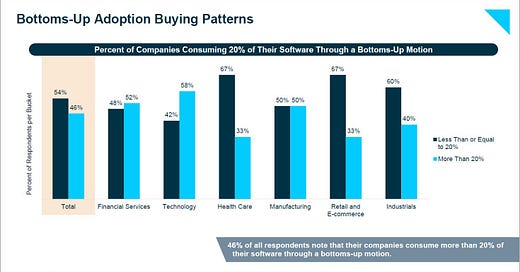

Battery, a top VC firm who backed Amplitude, Marketo, & Coinbase just released a 48-page research paper on ‘State of Software Spend’ that CFOs/CROs/CEOs are reading. One of its findings is bad news for PLG.

Source: Battery Ventures

In recent years, SaaS companies have fully embraced Product-Led Growth as a major revenue driver, and many traditionally “sales-led” companies have initiated a bottoms-up motion.

Although PLG adoption as a growth strategy is more popular than ever, individual contributors have diminished procurement power in 2023.

Company leaders are restricting how people self-serve buy tools, and are deploying software systems to control spending & budgets, like Brex, Rippling, Vendr, Tropic.

The observation is nerve-racking for product-led companies, as it adds to the theory that PLG revenue is more impacted during tough economic conditions since customers have frequent opportunities to churn. Whereas sales-led competitors have locked customers in multi-year contracts.

🔑 takeaway: Letting end-users get value from your product isn’t sufficient anymore. User success needs to be tied to quantifiable business value, and end-users must be empowered to build cases for further adoption. Without ROI numbers to back your product’s claims, individual power users might not be able to generate paid conversions.

❌ Stop relying on humans for lead scoring

Top PLG companies are turning to AI for a specific part of their revenue process: lead scoring. Here’s why ⬇️

Source: Giphy

Most companies score leads by having their marketing or growth teams randomly assign criteria from gut instincts, persona documentation, and subjective interpretation of customer behavior.

At scale, scoring PQLs is borderline impossible for 5 reason:

Data volume: Product data adds a 3rd layer of complexity to your score. Also, opening your top-of-funnel means you have more people trying your product, thus more data to keep track of overall.

Inaccuracy. Humans aren’t great at finding trends in immense quantities of data: At a certain scale, traditional scoring systems start to fail because of our inability to find imperceptible trends.

Biases: Growth and marketing team likely has biases concerning which criteria they see as most useful for sales. Biases might not correlate to potential revenue yet weigh heavily in your scoring model.

Adaptability: Updating the model as the customer experience changes (pricing update, new feature, updated onboarding) is almost impossible at scale.

Speed: Iterating manual scores is slow. Not only are revenue folks at the mercy of growth and ops teams, but there’s often no efficient communication between teams who use the score and teams who create the score.

🆚 PLG vs enterprise

"Product-led growth is not applicable to our enterprise business". Leah Tharin explained why that’s BS and why PLG must work alongside enterprise sales.

Source: Leah Tharin

Why PLG and top-down sales must get along:

Expansion: If you start to master lower-value accounts, some of them will expand into enterprise accounts. This means your products need to be able to scale with companies in the longer term, and your sales team needs to be able to run expansion plays.

The #1 hurdle to overcome:

Goals: Your goal is business success. The teams care about customer success. How to connect the two while keeping them separate is the secret sauce. "Decrease churn by 5%" is a great company goal and an awful team goal. Product teams can achieve that by making it harder to unsubscribe - but is that good?

🔑 takeaway: Realign goals and compensation to incentivize teams towards outcomes that create value for customers. Have clear hypotheses as to how customer value will turn into value captured for your business.

Onwards: The difficulty is when we move to higher-value accounts. Product teams have less data to utilize for decision-making, and sales need to go through more hurdles to close deals. PLG + top-down sales is the key behind Stripe’s bottom-up enterprise play.

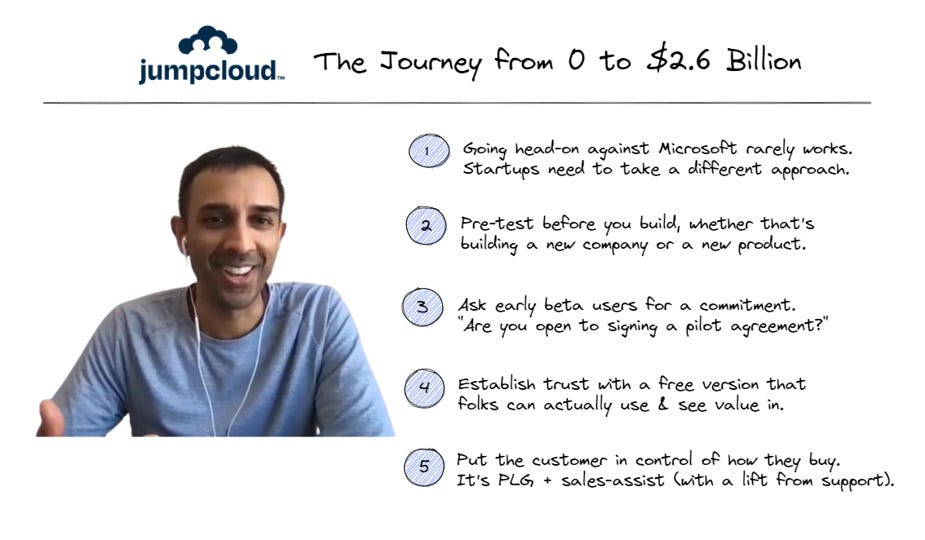

💣 Using PLG to take Microsoft down

Going head-on against Microsoft rarely works. Rajat Bhargava, JumpCloud’s Co-Founder & CEO, has succeeded. Kyle Poyar broke down how the right PLG strategy can beat behemoths.

Source: Growth Unhinged

Pre-test before you build: The team wrote six different white papers that talked about the concept of what they wanted to build, but had different messages like “Breaking Up with Active Directory” or “Benefits of SaaS-based LDAP” or “Cloud Directory with Google”. JumpCloud amplified these white papers with Google AdWords around different keywords. They measured how many people clicked on the ads, how many converted to downloading the white paper, and how many actually contacted JumpCloud.

Set PLG core values:

Value 1 - Freedom and openness: Unlike other freemium offerings that gated valuable features behind a paywall, JumpCloud’s free offering would include everything for free, no credit card required, and no time bomb.

Value 2 - Empowering success: JumpCloud’s PLG marketing strategy was relatively simplistic in the early days. It was about writing and distributing high quality technical content for IT admins on whatever problem they had. JumpCloud wrote thousands of articles.

Value 3 - Security: Since the main way people get hacked is through identity, JumpCloud needed to take security seriously from the beginning.

Sales-assist: JumpCloud is critical infrastructure for its customers and a highly considered purchase. Prospective customers want to both try it out themselves AND talk to someone at JumpCloud. The key was to put the customer in control over their process and how they want to buy.

JumpCloud’s sales cycle is “pretty fast, sub 60 days”. During that entire evaluation period, JumpCloud provides an opportunity for people to reach out through chat, email, technical support, or opt into a sales demo.

🎁 Cheat sheets & templates

Part 2: LinkedIn secrets you need to know.

How to automate emails with ChatGPT

10 things great salespeople do constantly.

Interview questions 20 top product leaders swear by

📊 New Data

March state of software spend

Do podcasts work for B2B?

Take 3 min to answer the PLS survey

🎧 and 📺

What’s the right culture for your company

The pitfalls of wrong incentives and silos

The jobs-to-be-done framework for marketers

🔥 Hot conversations

Turns out that interruptions and overtalk help you win deals.

You likely have a ton of useful content on your site.

A business lesson from the king of hot sauce.